Starting with Lafayette TN insurance, the discussion delves into the crucial aspects of insurance coverage in this region, shedding light on its significance and impact on residents.

Exploring the different types of insurance available, the role of insurance agents, and the factors influencing insurance rates, this overview aims to provide a comprehensive understanding of insurance in Lafayette, TN.

Overview of Lafayette, TN Insurance: Lafayette Tn Insurance

Insurance plays a crucial role in Lafayette, TN, providing financial protection and peace of mind to individuals and businesses in the community. Residents in Lafayette commonly seek various types of insurance, including auto, home, health, and life insurance. Insurance agents in Lafayette serve as knowledgeable professionals who help clients navigate the complex insurance market, find suitable coverage options, and assist with claims when needed.

Factors Influencing Insurance Rates in Lafayette, TN

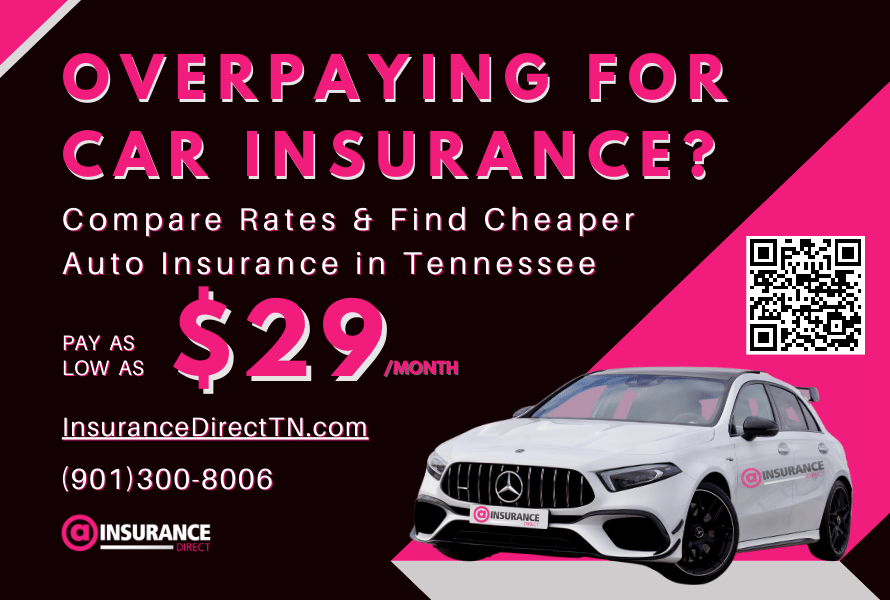

Several factors can influence insurance rates in Lafayette, TN, such as the type of coverage, deductible amount, driving record, credit score, and the location of the insured property. It’s essential to compare rates across different insurance providers to ensure you’re getting the best coverage at a competitive price. Demographics and location also play a significant role in determining insurance rates, with urban areas often facing higher premiums due to increased risks.

Common Insurance Claims in Lafayette, TN, Lafayette tn insurance

Residents in Lafayette frequently file insurance claims for incidents like car accidents, property damage, medical expenses, and natural disasters. The process of filing a claim involves contacting your insurance company, providing necessary documentation, and working with adjusters to assess the damages. Understanding the most common reasons for insurance claims can help individuals better prepare for unexpected events and ensure they have adequate coverage.

Importance of Local Insurance Companies in Lafayette, TN

Choosing a local insurance company in Lafayette offers various benefits, including personalized service, quick response times, and a deeper understanding of the community’s unique insurance needs. Local insurance companies provide a range of services, from customizing policies to offering tailored coverage options that meet specific requirements. Additionally, these companies play a vital role in supporting the local economy and contributing to the overall well-being of Lafayette, TN residents.

End of Discussion

Concluding the exploration of Lafayette TN insurance, it becomes evident that securing the right insurance coverage is not just a financial decision but a means to safeguard one’s assets and well-being in the vibrant community of Lafayette, TN.

FAQ Explained

What are the most sought-after types of insurance in Lafayette, TN?

In Lafayette, TN, residents commonly seek home insurance, auto insurance, and life insurance for comprehensive coverage.

How do demographics influence insurance rates in Lafayette, TN?

Different age groups, professions, and lifestyle choices can impact insurance rates in Lafayette, TN, affecting the overall cost of coverage.

Why is choosing a local insurance company beneficial in Lafayette, TN?

Local insurance companies offer personalized service, local expertise, and a deeper understanding of the community’s insurance needs, making them a preferred choice for residents.