How much is auto insurance in Massachusetts sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. Auto insurance in Massachusetts is not just about costs; it’s about understanding the factors that influence rates, exploring ways to save, and navigating the unique regulations in the state.

Overview of Auto Insurance in Massachusetts

Auto insurance in Massachusetts is a mandatory requirement for all drivers in the state. Having auto insurance provides financial protection in case of accidents, injuries, or property damage. Massachusetts has unique regulations, such as the “no-fault” system, which requires drivers to carry Personal Injury Protection (PIP) coverage in addition to liability insurance.

Factors Influencing Auto Insurance Rates in Massachusetts, How much is auto insurance in massachusetts

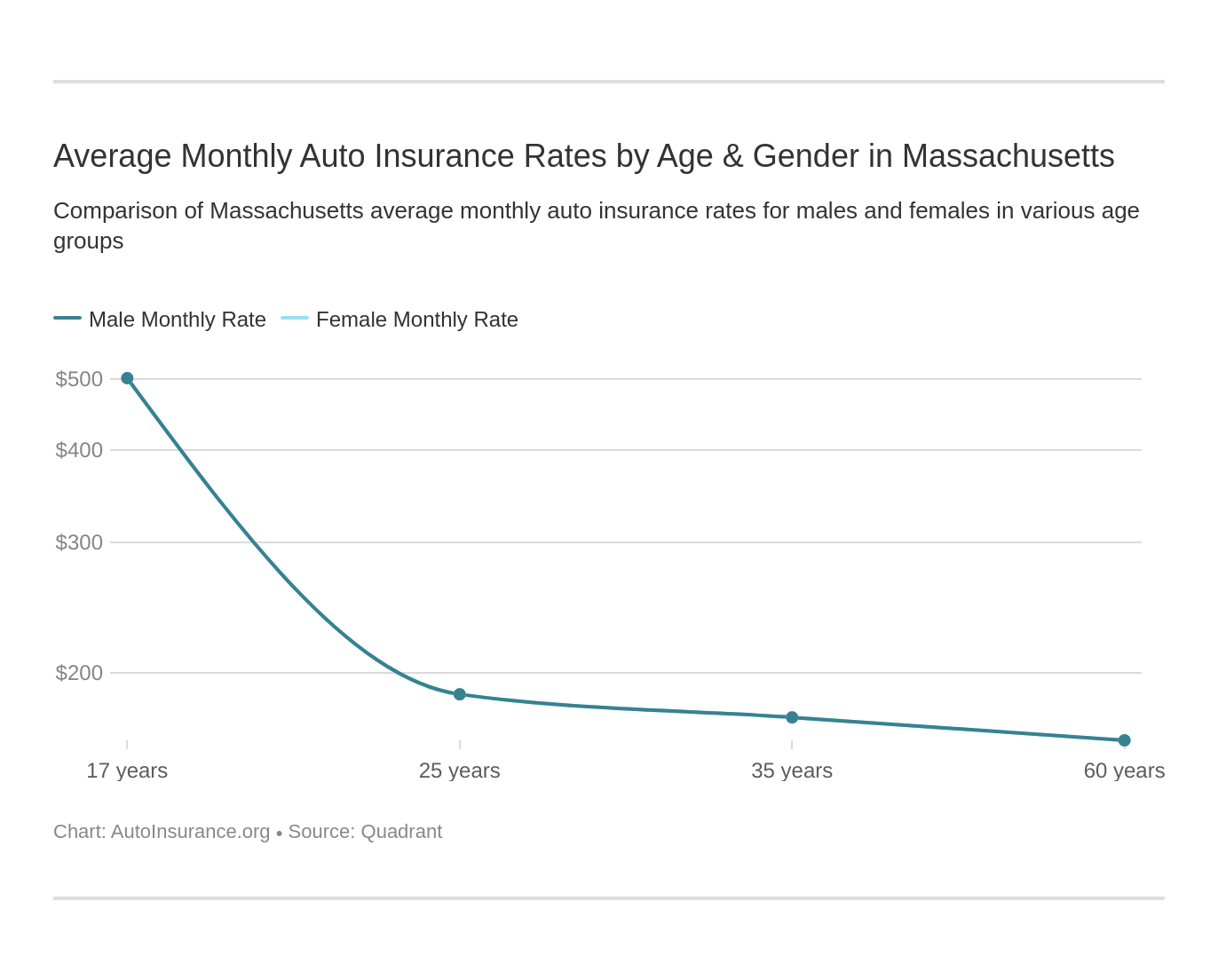

Several key factors influence auto insurance rates in Massachusetts, including the driver’s age, driving record, and type of vehicle. Younger drivers and those with a history of accidents or traffic violations typically pay higher premiums. The location of the insured vehicle and the coverage options selected also impact insurance costs in Massachusetts.

Average Cost of Auto Insurance in Massachusetts

The average cost of auto insurance in Massachusetts varies depending on factors such as age, vehicle type, and coverage levels. On average, drivers in Massachusetts pay around $1,200 to $1,500 per year for auto insurance. Rates may differ for different age groups or vehicle types, with luxury cars or sports cars often commanding higher premiums.

Ways to Save on Auto Insurance in Massachusetts

To save on auto insurance in Massachusetts, drivers can take advantage of discounts offered by insurance companies. These discounts may be available for safe driving habits, bundling policies, or completing a defensive driving course. Choosing higher deductibles or reducing coverage for older vehicles can also help lower insurance premiums.

Wrap-Up: How Much Is Auto Insurance In Massachusetts

In conclusion, understanding how much auto insurance costs in Massachusetts is just the beginning. By delving into the influencing factors, average costs, and savings opportunities, drivers can make informed decisions to protect themselves and their vehicles. With the right knowledge, securing auto insurance in Massachusetts can be a smooth journey towards financial protection and peace of mind.

Popular Questions

How do factors like age and driving record impact auto insurance rates in Massachusetts?

Factors like age and driving record can significantly influence auto insurance rates in Massachusetts. Younger drivers or those with a history of accidents may face higher premiums.

Are there specific programs in Massachusetts to help reduce auto insurance costs?

Yes, Massachusetts offers various discounts and programs to help drivers save on auto insurance. Examples include good driver discounts and bundling policies.

What are some effective ways to save on auto insurance in Massachusetts?

Drivers can save on auto insurance in Massachusetts by comparing quotes, maintaining a good driving record, taking advantage of available discounts, and adjusting coverage options.