Introduction

In today’s financial landscape, managing debt efficiently is crucial for maintaining healthy credit and financial stability. Among various types of loans, private loans often come with higher interest rates and less flexible terms compared to government-backed loans. Refinancing a private loan can be a powerful financial strategy to reduce interest costs, improve monthly cash flow, and consolidate debt.

This comprehensive guide delves into the concept of refinancing private loans—what it means, how it works, the benefits and risks involved, and practical steps to successfully refinance your private loan. Whether you are dealing with student loans, personal loans, or other types of private debt, understanding refinancing options can help you make informed decisions and achieve better financial outcomes.

1. What is a Private Loan?

Before exploring refinancing, it’s important to clarify what a private loan is:

-

Private loans are non-governmental loans issued by banks, credit unions, online lenders, or financial institutions.

-

They typically have variable interest rates, shorter repayment terms, and fewer borrower protections than federal or government loans.

-

Common private loans include private student loans, personal loans, and some types of business loans.

-

Private loans often have stricter qualification criteria based on credit score, income, and financial history.

Private vs. Federal Loans

For example, private student loans differ significantly from federal student loans. Federal loans offer fixed interest rates, income-driven repayment plans, and deferment options, while private loans do not have these benefits.

2. What Does It Mean to Refinance a Private Loan?

Refinancing a private loan means replacing your existing loan(s) with a new loan—typically with better terms—to improve your financial situation. When you refinance, you apply for a new loan from a lender, which pays off your original loan balance. Afterward, you owe the new lender under the new loan terms.

Key Points of Loan Refinancing

-

The new loan may have a lower interest rate.

-

It can extend or shorten the repayment term.

-

You might change from a variable to a fixed interest rate or vice versa.

-

It can consolidate multiple loans into one monthly payment.

-

It requires a credit check and approval by the refinancing lender.

3. Why Consider Refinancing a Private Loan?

Refinancing a private loan offers several advantages:

A. Lower Interest Rates

-

One of the main reasons borrowers refinance is to secure a lower interest rate.

-

A lower rate reduces the overall interest paid over the life of the loan, saving money.

B. Reduced Monthly Payments

-

Refinancing can extend your loan term, reducing monthly payments and improving cash flow.

-

This is beneficial if you need more financial breathing room but may increase total interest costs.

C. Simplify Finances

-

If you have multiple private loans, refinancing can consolidate them into a single payment.

-

This reduces administrative hassle and risk of missing payments.

D. Change Loan Terms

-

Switching from a variable to fixed rate loan can provide payment stability.

-

Alternatively, shortening the term can help you pay off debt faster.

E. Improve Loan Conditions

-

Some refinanced loans offer better customer service, flexible repayment options, or perks like autopay discounts.

4. Who Should Refinance Their Private Loans?

Not every borrower benefits from refinancing. Consider refinancing if:

-

You have a good credit score (generally 650+).

-

Your income has increased since taking out the original loan.

-

Interest rates have dropped since you borrowed.

-

You want to lower monthly payments.

-

You want to consolidate multiple loans.

-

You have private loans with high variable interest rates.

-

You can qualify for better loan terms.

5. When Should You Avoid Refinancing?

Refinancing may not be ideal if:

-

You have federal loans mixed with private loans—refinancing federal loans into private loans causes loss of federal benefits.

-

Your credit score has dropped significantly.

-

Your income is unstable or decreased.

-

The new loan has high fees or prepayment penalties.

-

You want to keep deferment, forbearance, or income-driven repayment options tied to original loans.

6. The Refinancing Process Explained

Refinancing a private loan typically follows these steps:

Step 1: Assess Your Current Loans

-

Gather loan statements to understand balances, interest rates, monthly payments, and terms.

Step 2: Check Your Credit Score and Financial Health

-

A strong credit score and steady income increase chances of approval and better terms.

Step 3: Research Lenders

-

Compare multiple lenders—banks, credit unions, online lenders.

-

Review interest rates, terms, fees, customer service reputation.

Step 4: Prequalify (Optional)

-

Many lenders offer prequalification with a soft credit pull to estimate rates without affecting credit score.

Step 5: Apply for Refinancing

-

Submit a full application with personal, financial, and employment information.

-

Lenders will perform a hard credit inquiry.

Step 6: Review Offers

-

Evaluate loan offers including interest rate, term length, monthly payment, fees, and borrower protections.

Step 7: Accept and Close

-

Choose the best offer, sign the loan agreement, and provide necessary documentation.

-

The new lender pays off your existing loan(s).

Step 8: Start Repayment

-

Begin making payments to the new lender according to the agreed schedule.

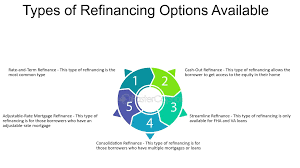

7. Types of Refinancing Options

A. Rate-and-Term Refinance

-

Lowers interest rate and/or changes loan term.

-

Keeps the same loan type and does not disburse extra funds.

B. Cash-Out Refinance

-

Borrowers take out a new loan for more than the balance owed and receive the difference as cash.

-

Increases debt but can be used for other expenses.

8. Factors Influencing Your Refinancing Offer

-

Credit score and history: Higher scores get better rates.

-

Debt-to-income ratio: Lower DTI improves chances.

-

Income and employment stability: Lenders want proof of steady earnings.

-

Loan amount and term: Larger loans or longer terms may affect rate.

-

Market interest rates: Economic conditions influence available rates.

9. Potential Costs and Fees

Refinancing isn’t always free. Possible costs include:

-

Origination fees: Charged by lender to process loan.

-

Application fees: Upfront cost for credit checks and underwriting.

-

Prepayment penalties: Fees for paying off original loan early (less common with private loans).

-

Closing costs: Expenses related to paperwork and legalities.

Always calculate if potential savings outweigh these costs.

10. Benefits of Refinancing Private Student Loans

Private student loans lack the protections and flexible repayment plans of federal loans. Refinancing them can:

-

Lower interest rates by leveraging improved credit.

-

Consolidate multiple private loans into a single manageable payment.

-

Switch from variable to fixed rates for payment stability.

-

Shorten repayment terms to save on interest if affordable.

11. Risks and Drawbacks to Consider

-

Refinancing into a longer-term loan may reduce monthly payments but increase total interest paid.

-

Losing access to borrower protections like deferment or forgiveness if refinancing federal loans.

-

Risk of higher interest rates if market conditions worsen.

-

Potential impact on credit score from hard inquiries.

12. How to Maximize the Benefits of Refinancing

-

Improve credit score by paying down other debts before refinancing.

-

Pay attention to the loan term and balance lower payments with total cost.

-

Compare multiple offers carefully.

-

Consider automatic payments discounts.

-

Read fine print for hidden fees.

13. Alternatives to Refinancing

If refinancing isn’t a fit, consider:

-

Loan consolidation: Bundling loans without changing terms.

-

Income-driven repayment plans: For federal loans.

-

Debt management plans: Through credit counseling.

-

Negotiating with lenders: For lower rates or payment plans.

-

Debt settlement: As a last resort.

14. Frequently Asked Questions (FAQs)

Q1: Can I refinance both federal and private loans together?

No, refinancing federal loans with a private lender results in losing federal protections. You can only refinance private loans together.

Q2: Will refinancing hurt my credit?

The hard inquiry during application can cause a slight temporary dip, but timely payments on the new loan improve credit over time.

Q3: How much can I save by refinancing?

Savings depend on interest rates, loan balance, and term. Use loan calculators to estimate.

Q4: Can I refinance with bad credit?

It’s challenging but possible with higher interest rates or co-signers.

15. Conclusion

Refinancing a private loan is a valuable financial tool for borrowers seeking to reduce interest costs, lower monthly payments, or consolidate debt. It requires careful consideration of current loan terms, credit standing, lender offers, and personal financial goals. By understanding the refinancing process, benefits, and risks, borrowers can make informed decisions that align with their long-term financial well-being.

Whether you have private student loans, personal loans, or other private debt, refinancing can be a smart step toward managing your obligations more efficiently. Always shop around, compare offers, and consider consulting with a financial advisor to maximize your refinancing benefits.